Don't Miss Collecting All Your Solar Incentives

Going solar isn’t just about energy efficiency—it’s a smart financial decision. At Solar Tax Max, we specialize in helping homeowners and businesses claim maximum tax credits, rebates, and incentives under the Inflation Reduction Act (IRA) and other federal and state programs. Our team ensures you receive the savings you’re entitled to—without the hassle.

our simple process

Why Trust Solar Tax Max?

1

Industry Experts

We maximize your solar incentives with expert knowledge

2

Hassle-Free Process

Our team handles the paperwork from start to finish.

3

Nationwide Service

Helping homeowners and businesses across the U.S.

our simple process

Simplified Tax Filing Solutions

1

Check Eligibility

We assess your solar system and location to determine the tax credits and incentives available to you.

2

Claim Your Savings

3

Maximize Your Refund

Solar Tax Solutions

Comprehensive Solar Tax Solutions

Federal & State Tax Credits

Unlock the full 30% federal solar tax credit and take advantage of state-specific incentives to reduce your costs.

Rebate & Incentive Optimization

We identify and apply all available rebates, grants, and exemptions to ensure you receive every financial benefit.

Expert Tax Filing Assistance

Avoid mistakes and delays—our team handles all paperwork and compliance requirements for a seamless process.

Battery Storage & Energy Incentives

Get additional savings on battery storage, energy-efficient upgrades, and EV charging incentives to maximize your investment.

why us ?

Experience Matters

Years of Tax Strategy Solutions

Clients Benefiting from Our Services

Years of Navigating Solar Tax Regulations

Common Solar Refund Problems

Homeowners frequently encounter challenges when trying to claim solar refunds:

- No solar tax guidance – Most tax preparers aren’t solar experts.

- Misinformed about refunds – Many are told they’ll get refunds they’re not actually eligible for.

- Missed extra incentives – Thousands of dollars in unclaimed incentives often go unnoticed.

Pure Energy, Pure Future

Power Your Future with Smart Solar Savings

Lower Energy Costs

Slash your electricity bills with renewable energy savings.

Maximize Tax Benefits

Get the most out of federal and state solar incentives.

Eco-Friendly Living

Reduce your carbon footprint with clean, sustainable energy.

Energy Independence

Produce your own power and reduce reliance on the grid.

Smart Investment

Increase property value while enjoying long-term savings

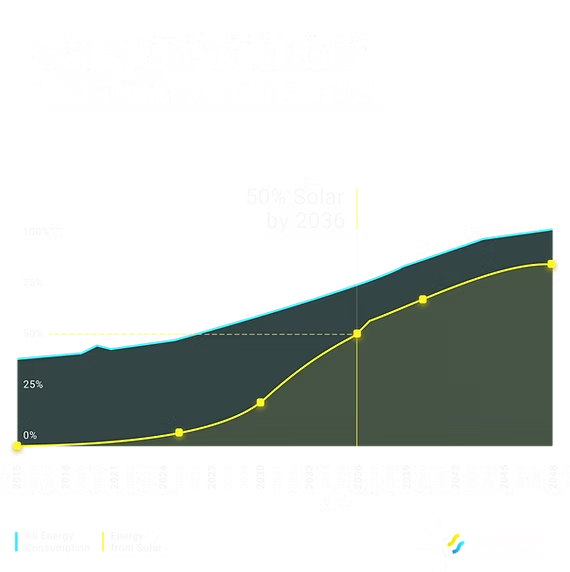

The Future of Solar Energy

Powering Over 50% by 2035

Our Core Values

Guiding Principles for a Sustainable Future

We specialize in maximizing solar tax benefits, ensuring you receive every incentive available. Our team stays up-to-date with the latest policies to secure the best financial outcomes for you.

Navigating tax credits and rebates can be overwhelming. We handle all the paperwork, filings, and submissions so you can focus on enjoying the benefits of solar energy.

Beyond savings, we believe in a cleaner, more sustainable future. By making solar incentives easy to access, we empower individuals and businesses to invest in renewable energy with confidence.

FAQs

general questions

What Are Solar Incentives?

Solar incentives are financial benefits offered to encourage the adoption of solar energy. These incentives can include tax credits, tax deductions, SRECs, and other State, local and utility incentives to make solar installations more affordable.

How Does The 30% Investment Tax Credit (ITC) Work?

The Investment Tax Credit (ITC) allows homeowners and businesses to deduct 30% of the cost of installing a solar energy system from their federal taxes. This credit is a significant financial incentive to promote the use of renewable energy.

When Can I Apply The 30% Investment Tax Credit?

The 30% Investment Tax Credit can only be applied in the tax year when the solar system was placed in service (operational).

Why Can't I Just Use My Current Tax Professional?

While many tax professionals are skilled in general taxation, Solar Tax Max™ specialize in the unique aspects of solar tax incentives. Our expertise ensures that you maximize your benefits and navigate the complexities of solar-related tax laws.

What Is Solar Tax Max™?

Solar Tax Max™ is our comprehensive plan designed to optimize your solar tax incentives. It includes expert guidance, timely tax refund analysis, and IRS forms required to collect your solar incentives.

How Much Does The Solar Tax Max™ Plan Cost?

The cost of the Solar Tax Max™ plan varies based on individual circumstances needs but the cost is generally much less than the benefit received.

Can I Use My Tax Credit To Pay Back Taxes?

In many cases, the 30% Investment Tax Credit can be used to offset federal tax liability.

Can You Help Me With A New Solar Proposal?

Yes, we can assist you with a new solar proposal and provide insight into potential extra solar incentives to ensure your proposal aligns with the latest solar tax laws. Schedule a consultation for personalized assistance. SolarTaxMax.com/book

REAL LIFE TESTIMONIALS

what Our Client's say